Accounts payable and its management is a critical business process through which an entity manages its payable obligations effectively. Accounts payable is the amount owed by an entity to its vendors/suppliers for the goods and services received. To elaborate, once an entity orders goods and receives before making the payment for it, it should record a liability in its books of accounts based on the invoice amount. This short-term liability due to the suppliers, vendors, and others is called accounts payable. Once the payment is made to the vendor for the unpaid purchases, the corresponding amount is reduced from the accounts payable balance.

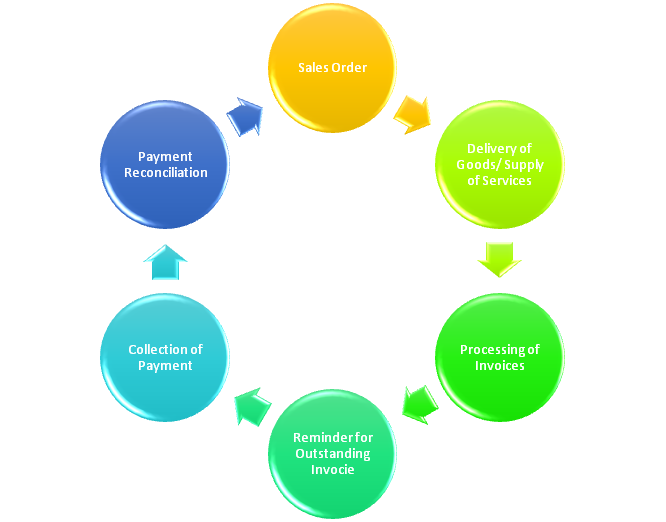

Account Payable process includes following.

- Issue Purchase Order

- Receive goods

- Processing of Invoice

- Check Credit Terms

- Make payment

- Bank Reconciliation

Following diagram explain it better.

Every entity will have an accounts payable department and its structure depends upon the size of the business. Accounts payable section is set up based on the probable number of vendors & service providers, the volume of the payments that would be processed for a period of time and the nature of reports that would be required by the management.

TAM help you in the management of Account Payable and reduce the penalty for late payment of invoices. Following are the benefit of using the Accounts payable from TAM

- Cost Effective - We provide AP service at very affordable price which reduce the operating cost of Business.

- Use credit term - By using our service the owner of business enjoy the benefit of Credit term which provided by vendor. Which also help in liquidity problem of business as well

- Periodically Reporting – We provide aged payable report on daily, weekly or monthly basis as per requirement of client. Which give clear understanding for our client how much amount they need to pay in coming period.